Palau Chamber Of Commerce for Dummies

Table of ContentsHow Palau Chamber Of Commerce can Save You Time, Stress, and Money.Getting My Palau Chamber Of Commerce To WorkLittle Known Facts About Palau Chamber Of Commerce.Palau Chamber Of Commerce for DummiesThe smart Trick of Palau Chamber Of Commerce That Nobody is Talking AboutThe Ultimate Guide To Palau Chamber Of CommerceSome Known Questions About Palau Chamber Of Commerce.Palau Chamber Of Commerce Fundamentals Explained

Not known Incorrect Statements About Palau Chamber Of Commerce

donation sizeContribution dimension the donation was made, who donatedThat contributed muchExactly how a lot they came to your website, internet site) And so on, ultimately pages make it convenient and hassle-free and also easy donors to give!

You could also take into consideration running an email project with normal e-newsletters that allow your viewers learn about the terrific job you're doing. Make sure to collect e-mail addresses as well as various other relevant data in an appropriate means from the get go. 8. 5 Care for your people If you have not tackled working with and onboarding yet, no concerns; currently is the time.

There are lots of contribution software application out there, and also not utilizing one can make on the internet fundraising fairly inefficient or perhaps difficult. It is essential to select one that is easy for you to establish as well as manage, is within your spending plan, and supplies a smooth donation experience to your benefactors. Donorbox is the most budget friendly donation platform out there, billing a tiny platform charge of 1.

More About Palau Chamber Of Commerce

To find out more, inspect out our write-up that speaks even more thorough concerning the main nonprofit financing sources. 9. 7 Crowdfunding Crowdfunding has actually turned into one of the crucial methods to fundraise in 2021. As an outcome, not-for-profit crowdfunding is getting hold of the eyeballs these days. It can be made use of for particular programs within the organization or a basic donation to the reason.

During this action, you might want to think concerning turning points that will certainly show a chance to scale your not-for-profit. As soon as you've operated for a little bit, it's essential to take some time to assume concerning concrete growth goals.

The smart Trick of Palau Chamber Of Commerce That Nobody is Talking About

Resources on Beginning a Nonprofit in different states in the US: Beginning a Nonprofit FAQs 1. Just how much does it set you back to begin a nonprofit company?

Just how long does it take to establish a not-for-profit? Depending on the state that you remain in, having Articles of Consolidation accepted by the state federal government may use up to a few weeks. When that's done, you'll have to apply for acknowledgment of its 501(c)( 3) standing by the Irs.

Although with the 1023-EZ type, the handling time is commonly 2-3 weeks. 4. Can you be an LLC and also a not-for-profit? LLC can exist as a not-for-profit minimal responsibility business, however, it ought to be entirely possessed by a solitary tax-exempt nonprofit organization. his explanation Thee LLC need to likewise meet the needs according to the internal revenue service required for Minimal Responsibility Business as Exempt Company Update - Palau Chamber of Commerce.

All About Palau Chamber Of Commerce

What is the distinction in between a structure as well as a not-for-profit? Structures are generally funded by a household or a corporate entity, however nonprofits are moneyed with their incomes and fundraising. Structures generally take the cash they started out with, invest it, and after that distribute the cash made from those financial investments.

Whereas, the additional money a nonprofit makes are used as operating costs to money the company's mission. Is it tough to start a nonprofit organization?

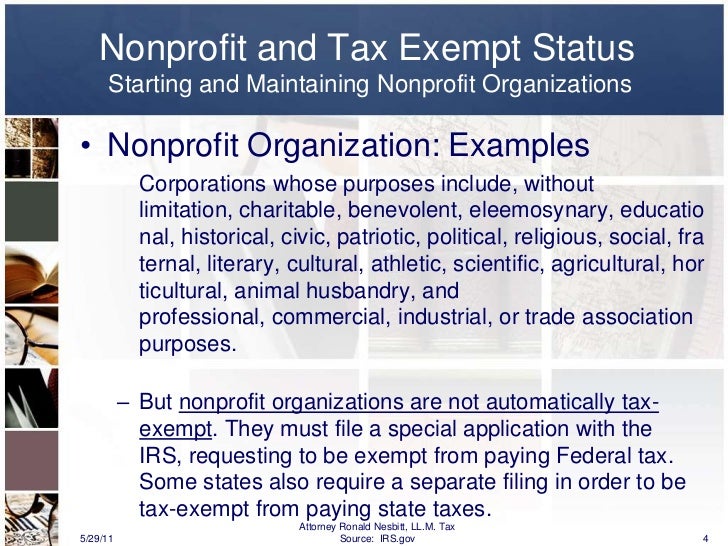

There are a number of actions to start a not-for-profit, the obstacles to access are reasonably couple of. Do nonprofits pay taxes? If your nonprofit gains any type of income from unrelated activities, it will owe income tax obligations on that quantity.

The 20-Second Trick For Palau Chamber Of Commerce

The role of a not-for-profit organization has actually constantly been to develop social adjustment and also lead the method to a better world., we focus on options that assist our nonprofits increase their donations.

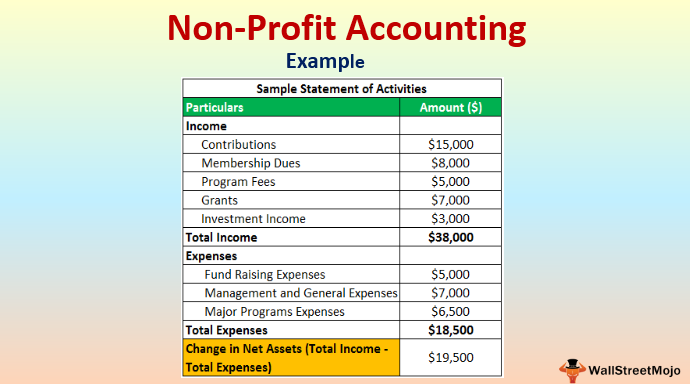

Twenty-eight various types of nonprofit companies are identified by the tax obligation legislation. By far the most usual kind of nonprofits are Section 501(c)( 3) companies; (Area 501(c)( 3) is the my link part of the tax obligation code that licenses such nonprofits). These are nonprofits whose goal is philanthropic, spiritual, educational, or clinical. Area 501(c)( 3) organization have one substantial benefit over all various other nonprofits: contributions made to them are tax obligation insurance deductible by the contributor.

This classification is very important because personal foundations go through stringent operating policies and also guidelines that do not use to public charities. As an example, deductibility of contributions to an exclusive structure is extra minimal than for a public charity, and also private structures go through excise tax obligations that are not troubled public charities.

Top Guidelines Of Palau Chamber Of Commerce

The visit this web-site bottom line is that personal structures get much worse tax therapy than public charities. The main difference between personal foundations and also public charities is where they obtain their monetary support. A private foundation is usually controlled by an individual, family, or company, as well as obtains a lot of its earnings from a few donors as well as investments-- an example is the Expense and also Melinda Gates Structure.

This is why the tax regulation is so hard on them. A lot of foundations just offer money to other nonprofits. Somecalled "operating foundations"run their very own programs. As a functional matter, you require at the very least $1 million to start a personal structure; otherwise, it's not worth the problem and also expenditure. It's not surprising, after that, that an exclusive foundation has actually been called a large body of money surrounded by individuals who want a few of it.

Other nonprofits are not so lucky. The internal revenue service initially presumes that they are exclusive foundations. Palau Chamber of Commerce. A new 501(c)( 3) organization will certainly be classified as a public charity (not an exclusive structure) when it uses for tax-exempt condition if it can show that it sensibly can be anticipated to be publicly supported.

How Palau Chamber Of Commerce can Save You Time, Stress, and Money.

If the internal revenue service identifies the not-for-profit as a public charity, it keeps this condition for its initial five years, despite the public support it really receives throughout this time. Beginning with the not-for-profit's sixth tax obligation year, it must show that it satisfies the public support examination, which is based upon the support it gets throughout the existing year and previous four years.